Cash vs. Accrual vs. Modified Accounting: Which One is Right for You?

When it comes to accounting, businesses have three main choices: cash accounting, accrual accounting, or a hybrid called modified cash basis accounting. Each method tracks financial transactions differently, impacting how you manage cash flow, tax reporting, and overall financial planning. Whether you're a small business owner, freelancer, or running a larger operation, picking the right accounting method can make a world of difference in your success.

Understanding Cash Accounting: Simple and Straightforward

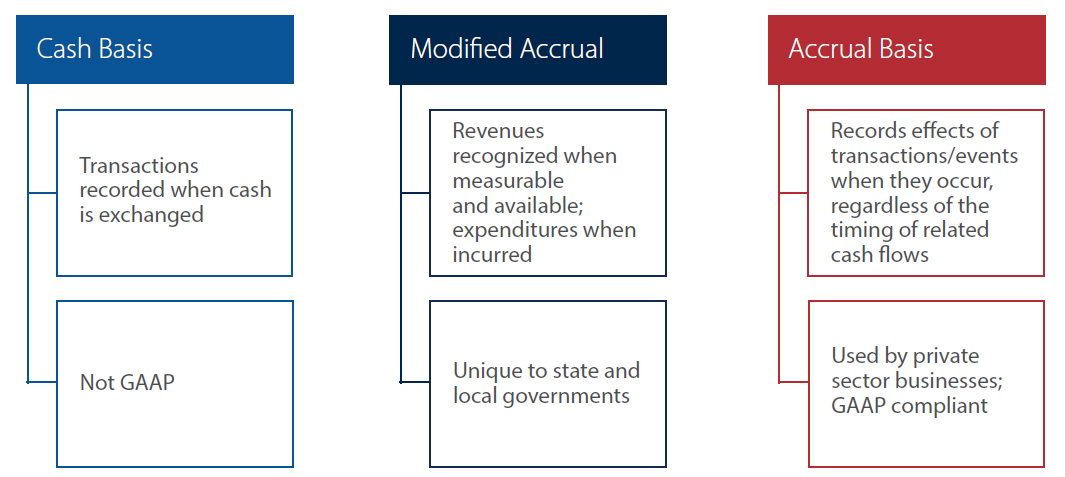

Cash accounting is one of the easiest methods to understand and use—money in, money out. You record revenue when you receive cash payments and track expenses only when you pay them. There's no need to deal with unpaid invoices or outstanding bills, making it a straightforward bookkeeping system that works well for small businesses.

This method is ideal for freelancers, sole proprietors, or businesses that primarily deal in cash transactions. Since cash accounting tracks only real money transactions, it provides a clear view of how much cash flow you have at any given moment. If there's money in your account, you're good; if not, it's time to drive sales.

However, the downside of cash accounting is that it doesn’t always reflect the full financial picture of your business. For example, if you’ve provided a service but haven’t been paid yet, that income doesn’t appear on your financial statements. This could make your business look less profitable than it actually is.

📌 Learn more about cash accounting from Investopedia or explore cash accounting software options at QuickBooks.

The Power of Accrual Accounting: A Deeper Financial Picture

Accrual accounting is the preferred method for businesses that need a more accurate financial representation of their performance. Instead of waiting for cash payments, this method records income when it’s earned and expenses when they are incurred, regardless of when money actually changes hands.

Let’s say you send an invoice to a client in January, but they don’t pay until March. With accrual-based accounting, you still record that income in January when the service was provided. The same applies to expenses—if you receive a bill today but won’t pay it until next month, you still log it as an expense now.

Accrual accounting provides a detailed financial overview, making it easier to track profitability, plan for business growth, and comply with tax regulations. It’s also a requirement for larger businesses, especially those earning more than $25 million in annual revenue, according to IRS accounting rules.

On the downside, accrual accounting requires more effort, bookkeeping knowledge, and sometimes professional accounting software to manage efficiently. Since revenue and expenses are recorded before money moves, it’s possible to appear profitable on paper while struggling with cash flow problems.

📌 Want to dive deeper into accrual accounting? Read this guide from FreshBooks or review official IRS rules on accrual vs. cash accounting.

Modified Cash Basis: The Best of Both Worlds?

If cash accounting feels too simple and accrual accounting seems too complex, modified cash basis accounting could be the best compromise. This hybrid accounting method combines elements of both, giving you flexibility while maintaining a structured approach to financial tracking.

With modified cash accounting, you record revenue and expenses like cash accounting—only when transactions occur. However, you also incorporate accrual-like tracking for certain assets and liabilities, such as accounts payable, accounts receivable, and large purchases that depreciate over time.

For example, with modified cash accounting, you might record daily expenses like rent and utilities when paid but track larger business assets over time like in accrual accounting. This method provides more financial insight than cash basis but without the full complexity of the accrual method.

Modified cash basis accounting is a popular option for small businesses and entrepreneurs who need a better financial reporting structure without fully committing to accrual accounting. It offers tax advantages, better cash management, and a more realistic picture of your business’s financial health.

📌 Not sure how modified cash basis works? Read this breakdown from Patriot Software or get professional insights from AccountingTools.

Choosing the Right Accounting Method for Your Business

So, which accounting method should you choose? It depends on your business structure, financial needs, and long-term goals.

- Cash Accounting: Best for small businesses, freelancers, and sole proprietors who want simple bookkeeping and focus on cash flow.

- Accrual Accounting: Ideal for growing businesses, companies with inventory, and those needing an accurate profit and loss statement.

- Modified Cash Basis: A balanced option for small businesses needing some accrual elements without the complexity of full accrual accounting.

No matter which method you choose, staying organized with your bookkeeping is essential. A strong accounting system helps you make better business decisions, avoid tax surprises, and ensure you always know where your money stands.

Final Thoughts on Accounting Methods

Understanding the differences between cash accounting, accrual accounting, and modified cash basis accounting is crucial for business success. Each method has its advantages and challenges, so take the time to assess which one fits your business model best.

If you're unsure which method is right for you, consulting with a bookkeeping expert or accounting professional can help you make an informed decision. No matter what, keeping your financial records accurate and staying on top of your business finances will set you up for long-term success.

📌 Want more accounting tips? Stay updated with expert advice from Investopedia’s Accounting Hub or learn best practices from QuickBooks Resource Center. 🚀