What is an Accounting Ledger? A Simple Guide to Tracking Your Business Finances

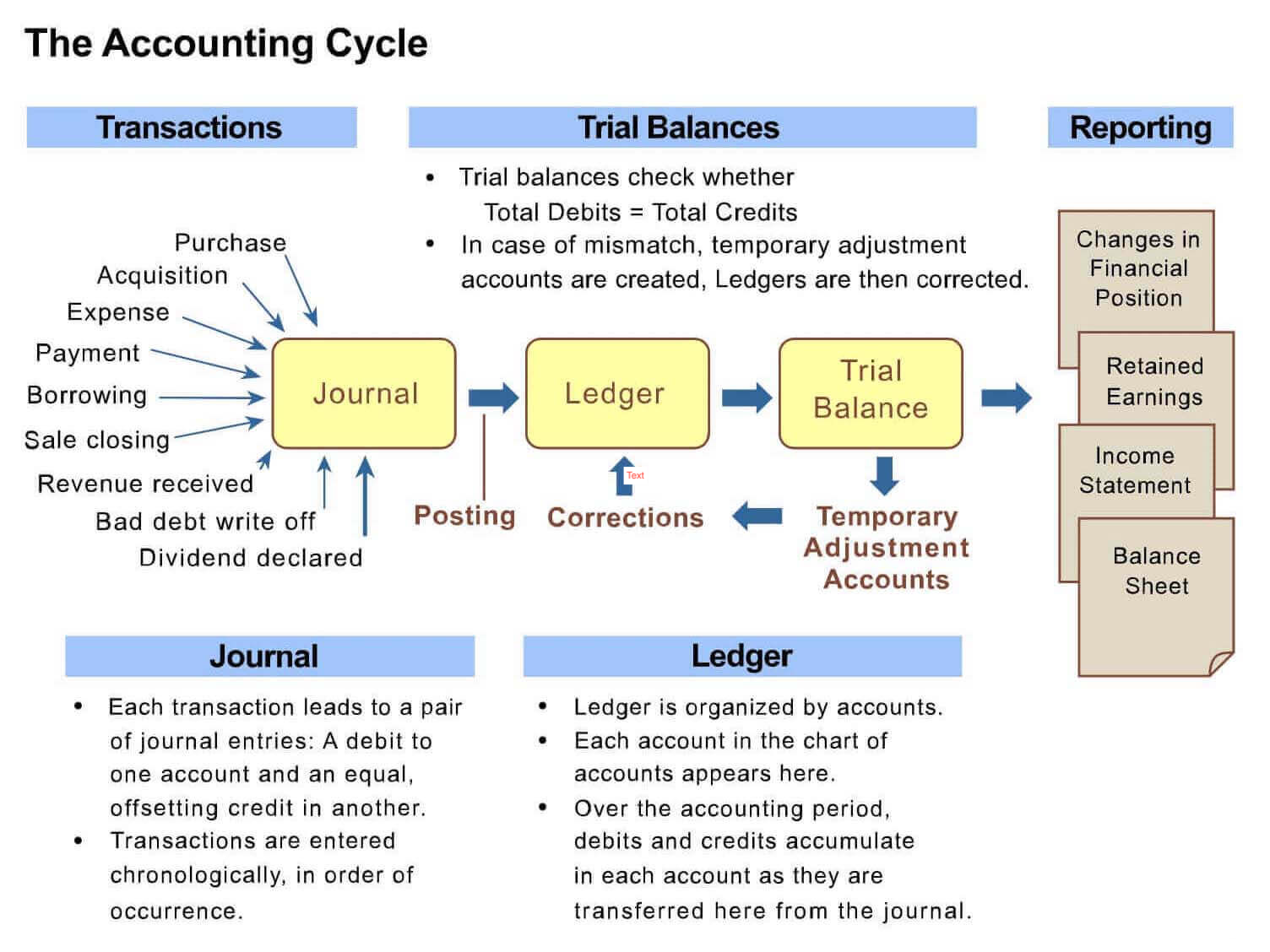

If you want to keep your business finances organized, an accounting ledger is your best friend. It’s the backbone of bookkeeping, where all your financial transactions are recorded in one place. Whether you’re managing small business accounting or handling a larger company’s financial records, understanding how a ledger works helps you track income, expenses, and profitability with ease.

Understanding the Basics: What is an Accounting Ledger?

An accounting ledger is a master record where all your financial transactions are logged. Think of it as a financial diary that tracks every dollar coming in and going out of your business. It helps you manage cash flow, maintain accurate financial statements, and prepare tax reports.

Every transaction in your ledger falls into specific accounting categories, such as:

- Assets (cash, inventory, equipment)

- Liabilities (loans, accounts payable)

- Equity (owner’s investment, retained earnings)

- Revenue (sales, service income)

- Expenses (rent, utilities, payroll)

An accurate ledger ensures that your financial reports, like the balance sheet and income statement, reflect your true business health. If your bookkeeping is messy, financial statements will be unreliable, making it harder to budget, forecast, or apply for business loans.

Types of Accounting Ledgers You Need to Know

There isn’t just one ledger in accounting—businesses use several, depending on their financial tracking needs.

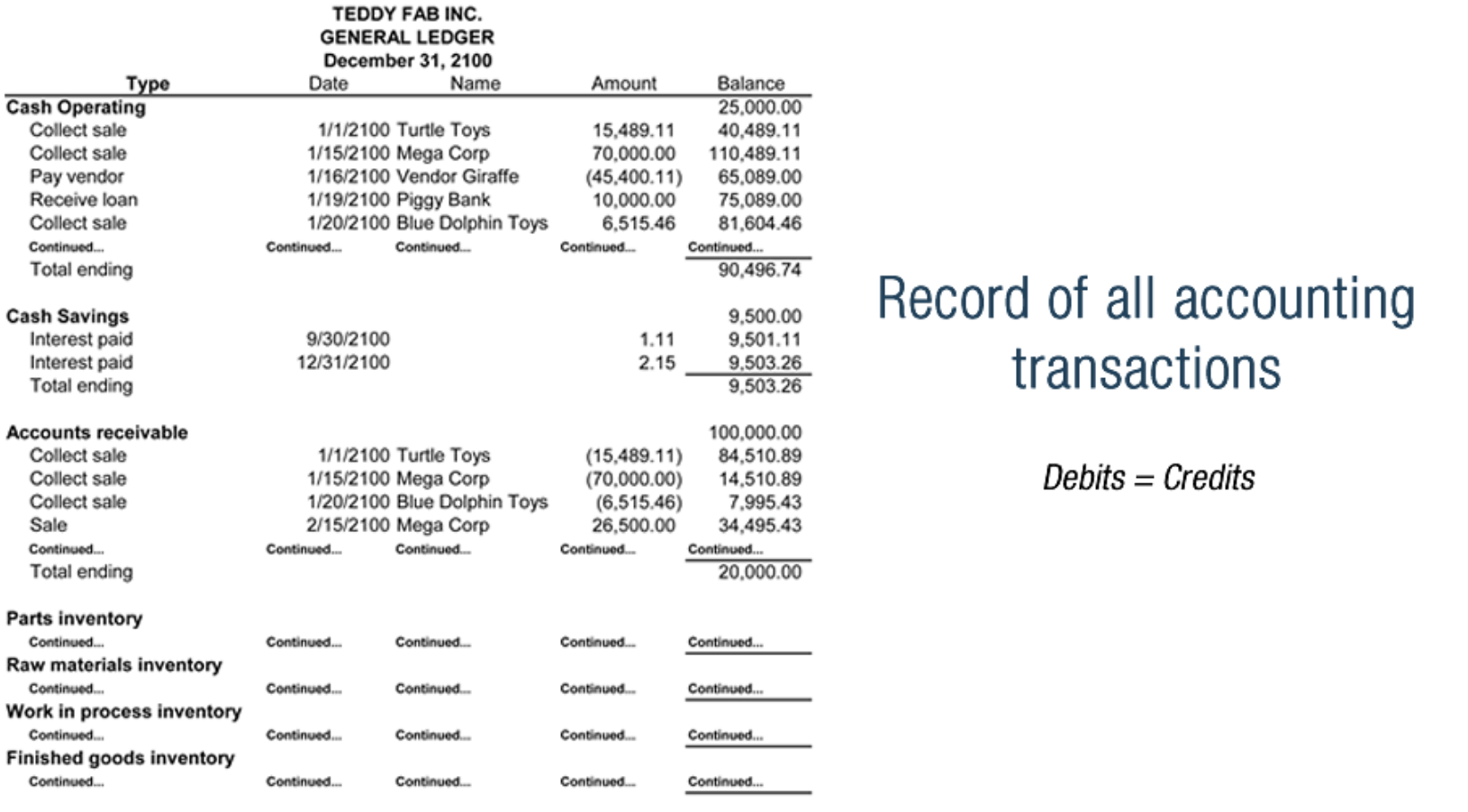

1. General Ledger: The Financial Command Center

The general ledger (GL) is the master record of all financial transactions. Every sale, expense, or adjustment is recorded here. It’s where all subsidiary ledgers connect, giving you a comprehensive view of your business’s financial health.

📌 Want to see how a general ledger works? Check out this guide from Investopedia.

2. Subsidiary Ledgers: The Details Behind Your Transactions

While the general ledger provides an overview, subsidiary ledgers offer detailed transaction records for specific accounts. Common types include:

- Accounts Receivable Ledger (tracks what customers owe you)

- Accounts Payable Ledger (tracks what you owe suppliers)

- Inventory Ledger (monitors stock levels and costs)

- Payroll Ledger (keeps employee salary records)

📌 Want to learn more about subsidiary ledgers? Read this article from FreshBooks.

Why is an Accounting Ledger Important for Your Business?

A well-maintained ledger ensures financial accuracy, compliance, and efficiency. Here’s why every business needs one:

✅ Tracks Every Financial Transaction – Ensures all income, expenses, and liabilities are recorded correctly.

✅ Helps Prepare Financial Statements – Used to create the income statement, balance sheet, and cash flow report.

✅ Ensures Tax Compliance – Makes reporting income and business deductions easy during tax season.

✅ Prevents Accounting Errors – Reduces discrepancies, missing transactions, and potential financial fraud.

✅ Supports Business Growth – Provides accurate financial insights, helping business owners make data-driven decisions.

How to Maintain an Accurate Accounting Ledger

A well-maintained ledger keeps your financial records accurate, up to date, and easy to analyze. Follow these best practices:

1. Record Transactions Frequently

Don’t wait until month-end to update your ledger. Log transactions daily or weekly to maintain real-time financial accuracy.

2. Use Accounting Software

Manually recording transactions is time-consuming and prone to errors. Software like QuickBooks, Xero, or FreshBooks automates ledger entries, making bookkeeping easier.

📌 Need accounting software? Compare the best options at QuickBooks.

3. Reconcile Your Accounts Regularly

Reconciliation ensures that your ledger balances match your bank statements. If there’s a mismatch, you might have missing transactions, duplicate entries, or financial fraud. Regular bank reconciliation prevents errors.

📌 Learn how to reconcile accounts with this tutorial from Xero.

4. Keep Digital and Physical Backup Records

Even with accounting software, always keep copies of receipts, invoices, and bank statements for tax filings and audits.

5. Hire a Professional Accountant

If ledger management feels overwhelming, consider hiring a bookkeeper or accountant. They ensure your financial records are error-free, tax-compliant, and properly structured.

📌 Looking for bookkeeping services? Check out trusted professionals on Bench.

Final Thoughts: Your Accounting Ledger is Your Financial Backbone

An accounting ledger is more than just a record of transactions—it’s the foundation of your business finances. Keeping it accurate and organized helps you track cash flow, prevent accounting errors, and plan for financial growth.

Whether you’re managing a small business, a startup, or a growing company, understanding your ledger helps you stay compliant, financially stable, and prepared for tax season.

📌 Want more accounting tips? Check out expert resources from Investopedia’s Accounting Hub or learn best practices from FreshBooks. 🚀